Nintendo FY18 Q3 Earnings

A blockbuster holiday. Lowered expectations. Three pillars of business. Nintendo’s recent earnings report was interesting if nothing else.

Brian Crecente at Variety gave a tight business side recap:

Despite a strong holiday, Nintendo on Thursday lowered how many Nintendo Switch it believes it can sell for the fiscal year, dropping the goal by three million, down to a new target of 17 million, the company announced in its latest earnings report.

The company also increased its Nintendo Switch game sales forecast by 10 million, saying it will sell 110 million copies of games for the system in the fiscal year, which ends in March. Finally, the company nearly halved its estimates for the sales of the portable 3DS systems, down from 4 million to 2.6 million.

The following are pulled from the presentation:

On Switch sales:

And cumulative global sell-through, including sales outside of the major markets you saw on the previous slides, has surpassed 30 million units as of the end of January, and the Nintendo Switch business is on a trajectory for further growth. Also, all of the new titles released in succession during the holiday season also showed exceptional sales.

Comparison to PS4 and Xbox One sell-through looks like this:

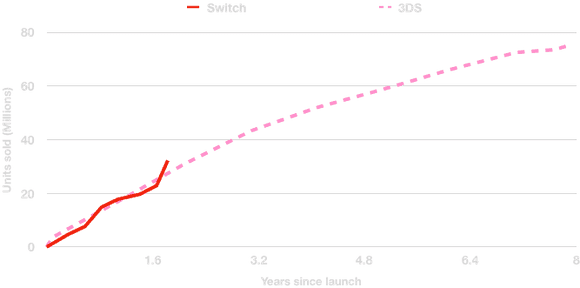

Comparison to the Nintendo 3DS looks like this:

On games:

Super Smash Bros. Ultimate has achieved a sell-through of over 10 million units. The title has continued to show explosive growth after its release, with the fastest start for any title on any Nintendo home console ever.

Right in-line with NPD’s numbers.

Continued:

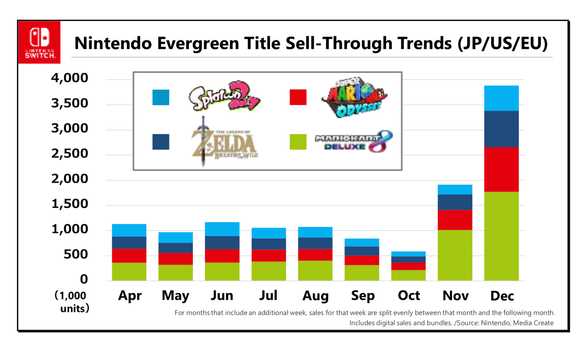

This chart shows the combined sell-through in Japan, the US, and Europe since April of 2018 for the four titles you see here. All four were released in the year before last, 2017. Sell-through of each title continued at a reasonable pace, then spiked upward toward the end of the year. As the spread of Nintendo Switch progresses, the number of new consumers is increasing. And to consumers who just purchased Nintendo Switch hardware, every existing title seems new.

One of Nintendo’s strengths is how easy it is for consumers with past experience playing Nintendo games to become interested in new Nintendo-brand titles. And if the steady sales of our evergreen titles can reliably support our overall software sales, we believe that will help fill any gaps between releases of new titles.

Mario Kart 8 Deluxe is the top selling title for the Nintendo Switch at 15.02 million units. Super Mario Odyssey is second at 13.76 million units. I still wouldn’t call Mario Kart 8 Deluxe a system seller, but certainly a must-have. Electrodome Boogaloo, indeed.

On third-party titles:

Titles from other software publishers are also seeing a steady rise alongside Nintendo Switch. Nintendo’s revenue related to software from other software publishers was more than twofold during April through December of 2018.

The idea that Microsoft would put games on Switch doesn’t seem so crazy.

On strategy:

Based on our basic strategy, we’ve organized the company’s initiatives into three pillars of business. The three pillars are the dedicated video game platform business, the mobile business, and the IP expansion business.

Each pillar has a different purpose and a different scale. They are each considered critical to the company, and we intend to grow them according to their unique traits and potential for growth. Let me explain each of these businesses in order.

Executives have made mention of IP expansion, but I don’t think I’ve ever seen it as core a pillar spelled out next to “video games”.